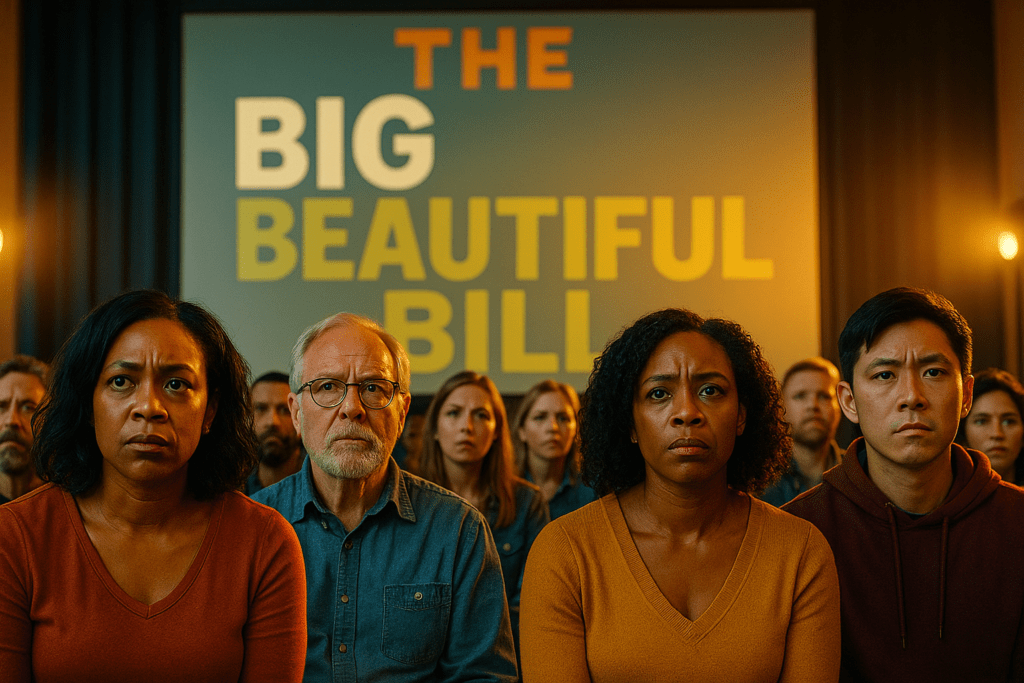

The Big Beautiful Bill: A Reckoning for Black Communities

By Darius Spearman (africanelements)

Support African Elements at patreon.com/africanelements and hear recent news in a single playlist. Additionally, you can gain early access to ad-free video content.

Unpacking the Big, Beautiful Bill

The “One Big Beautiful Bill Act,” often called the “Big Beautiful Bill” or OBBB, is a proposed budget reconciliation bill currently making its way through the 119th United States Congress. This legislation is not just another piece of policy; it represents a sweeping overhaul of federal spending and taxation, with profound implications for every American, especially those in vulnerable communities. A budget reconciliation bill is a special legislative tool that allows certain budget-related measures to pass the Senate with a simple majority vote, bypassing the usual 60-vote threshold needed to overcome a filibuster. This means it can be pushed through with less bipartisan support, making its passage potentially easier for the majority party (One Big Beautiful Bill Act).

The core of this bill involves extending significant portions of the 2017 Tax Cuts and Jobs Act, which are set to expire at the close of 2025. In addition to these extensions, the OBBB introduces new tax breaks, such as eliminating taxes on tips, overtime, and Social Security income through 2028. These tax cuts alone total an estimated $3.75 trillion (WDSU, Spectrum Local News). To offset this massive revenue loss, the bill proposes deep cuts to non-military government spending, particularly targeting essential social programs like Medicaid and the Supplemental Nutrition Assistance Program (SNAP). It also allocates an extra $150 billion for defense spending, scales back many clean-energy tax credits from the Inflation Reduction Act, and even introduces new taxes on solar and wind energy, while providing tax breaks for the coal and oil industries (One Big Beautiful Bill Act, BIPC).

Economic Fallout of the Bill

The financial implications of the “Big Beautiful Bill” are a central point of contention. The Congressional Budget Office (CBO), a nonpartisan federal agency tasked with providing objective budget and economic information to Congress, has released sobering projections. The CBO’s estimates are derived from complex economic and statistical models that analyze how proposed legislation might impact federal spending, revenues, and the broader economy. These models consider various factors, including how people might change their behavior in response to new policies, such as how tax cuts could affect work incentives or how changes to benefits might influence enrollment (FactCheck.org).

According to the CBO, the OBBB could add a staggering $2.4 trillion to the national debt over the next decade, specifically by 2034 (One Big Beautiful Bill Act, ABC11, WDSU). This projection stands in stark contrast to the claims made by the White House and supporters of the bill, who argue that the tax cuts will stimulate economic growth and ultimately increase government revenues (WDSU). The 2017 Tax Cuts and Jobs Act (TCJA), whose major provisions are being extended, significantly lowered corporate and individual income tax rates and increased the standard deduction. Its original intent was to spur economic growth by encouraging businesses to invest and individuals to spend more (One Big Beautiful Bill Act). However, analyses suggest that the extension of these tax benefits under the OBBBA would primarily benefit top earners, further widening the economic gap (GBPI).

Projected National Debt Increase

Healthcare Under Siege: Medicaid and Beyond

The proposed cuts to Medicaid within the “Big Beautiful Bill” are particularly alarming, representing the largest reductions to the program since its creation in 1965 (BriefingBook.info). The bill introduces new work and verification requirements for Medicaid enrollees. While specific details are still emerging, these requirements generally mandate that able-bodied adults without dependents must engage in work, job training, or community service for a certain number of hours each week to maintain their eligibility. Verification requirements would also involve stricter processes for proving income, residency, and other qualifying factors. These changes differ significantly from current Medicaid rules in many states, where such work requirements are not universally applied or are subject to broader exemptions (BIPC).

The human cost of these changes is projected to be immense. The CBO estimates that approximately 10.9 million people could lose health coverage over the next decade due to cuts to Medicaid and reduced subsidies for marketplace plans (One Big Beautiful Bill Act, GBPI). This includes an estimated 7.8 million people losing access to Medicaid alone (Wisconsin Examiner). When combined with the 5.1 million people already projected to lose coverage due to the expiration of enhanced premium tax credits at the end of 2025, the total potential loss of health coverage could reach approximately 16 million nationwide (GBPI). Dr. Adam Gaffney, a critical care physician and professor at Harvard Medical School, co-authored a report that paints an even grimmer picture, estimating that the bill could lead to 1.3 million Americans going without needed medications, 1.2 million being saddled with medical debt, 380,000 women going without mammograms, and over 16,500 deaths annually. These figures highlight the severe consequences of losing access to modern medical care, which is known to save lives.

Medicaid serves a broad spectrum of low-income Americans, including the chronically ill, disabled individuals, those requiring long-term care (including the elderly), children, pregnant people, and many working-age adults (BriefingBook.info). The proposed work requirements would disproportionately impact working-age individuals, many of whom are already working or have valid reasons for not working, such as illness or caregiving responsibilities. For Black communities, who often face higher rates of chronic illness, lower median wealth, and rely more heavily on social safety nets due to historical and systemic inequalities, these cuts would be particularly devastating. The loss of health insurance is directly correlated with adverse health outcomes, meaning these policy changes could exacerbate existing health disparities. Furthermore, many hospitals, especially those in rural areas and those serving disadvantaged groups, rely on Medicaid revenues for their operations. Taking a “sledgehammer” to this funding could force these hospitals to cut staff, reduce services, or even close, further eroding the healthcare infrastructure in areas that need it most (Wisconsin Examiner).

Cuts to Vital Programs

Beyond healthcare, the “Big Beautiful Bill” proposes significant cuts and changes to the Supplemental Nutrition Assistance Program (SNAP), which provides crucial food assistance to low-income individuals and families. The bill aims to reduce non-military government spending, including through stricter eligibility requirements for SNAP (One Big Beautiful Bill Act). This would likely mean that fewer people qualify for benefits, or the benefits themselves would be reduced for current recipients. These changes are expected to increase food insecurity, particularly for the lowest income quintile of Americans, who would see a reduction in their net resources by an average of $940, representing 13% of their after-tax-and-transfer income (BriefingBook.info). For Black families, who are disproportionately affected by poverty and food insecurity, these cuts could deepen existing hardships, making it even more challenging to put food on the table.

The bill also includes changes to higher education, particularly student loans, which would make getting an education more expensive (WDSU). This is a critical concern for working-class young people, including many from Black communities, who often rely on student aid and affordable education to achieve upward mobility. Making college harder to afford could limit opportunities and perpetuate cycles of economic disadvantage. In addition to these social program cuts, the bill proposes scaling back many of the clean-energy tax credits established by the Inflation Reduction Act. It also includes provisions for the repeal and modification of these energy tax provisions (One Big Beautiful Bill Act, BIPC). While the specific details of new taxes on solar and wind energy are not fully elaborated, the bill’s stated focus on “unleashing American energy” suggests a prioritization of traditional fossil fuel sources (BIPC). Clean energy tax credits typically incentivize renewable energy development and adoption, aiming to reduce carbon emissions and promote green jobs. The proposed changes would likely disincentivize investment in renewable energy, potentially slowing the transition to a cleaner energy grid and impacting the economic viability of solar and wind projects, while providing tax breaks for the coal and oil industries (WDSU).

Projected Impact on Vulnerable Populations

for lowest-income quintile

Political Divisions and Opposition

Despite President Trump’s strong push for the “Big Beautiful Bill” to pass by a July 4th deadline, the legislation faces significant opposition and internal divisions within the Republican party (ABC11). The bill narrowly passed the House in May, but some GOP members have expressed regret. For example, Georgia Representative Marjorie Taylor Greene stated she would have voted against it if she had known about a provision related to AI regulations, calling for its removal by the Senate (ABC11). There is also hesitation among some House Republicans to support Medicare cuts, given the reliance of many elderly GOP supporters on the program (New Republic). The optics of Representative Ralph Norman falling asleep during a House Rules Committee discussion on a bill that aims to strip Medicaid coverage from millions further highlight the internal struggles (New Republic).

In the Senate, the procedural vote was delayed for hours as Republicans worked out details, eventually passing 51-to-49, with two Republicans joining all Democrats in opposition: Rand Paul of Kentucky and Senator Thom Tillis of North Carolina. Senator Tillis, who announced he does not plan to seek re-election, stated on the Senate floor that the bill “will betray the very promise that Donald J. Trump made” (WDSU). Furthermore, the Senate parliamentarian ruled against two key carve-outs on Medicaid spending for senators in Alaska and Hawaii, making the vote of Alaska Republican Lisa Murkowski uncertain (Wisconsin Examiner). Critics have not minced words. Senator Chuck Schumer dubbed the bill the “Well, We’re All Going to Die Act,” arguing it would “mummify” millions in red tape, leading to higher premiums and weaker coverage (Spectrum Local News). Senator Bernie Sanders called it the “most dangerous piece of legislation in modern U.S. history,” describing it as a “gift to the billionaire class” and a reflection of a “corrupt campaign finance system” (WDSU). He also stated that it would “throw 16 million people off the healthcare they have” and make it harder for working-class young people to afford college.

Projected Health Coverage Loss

The “Big Beautiful Bill” stands as a stark example of legislative priorities that could reshape the American landscape for decades to come. Its blend of massive tax cuts for the wealthy and deep reductions in crucial social safety nets presents a challenging future for many, particularly for Black communities who often bear the brunt of such policy shifts due to existing systemic inequalities. The ongoing debate in Congress, marked by internal divisions and strong opposition, underscores the high stakes involved. As lawmakers continue to deliberate, the potential impacts on healthcare access, food security, educational opportunities, and environmental sustainability remain at the forefront of national concern. The outcome of this legislative battle will undoubtedly have profound and lasting consequences for the well-being of millions of Americans.

ABOUT THE AUTHOR

Darius Spearman has been a professor of Black Studies at San Diego City College since 2007. He is the author of several books, including Between The Color Lines: A History of African Americans on the California Frontier Through 1890. You can visit Darius online at africanelements.org.